This joint webinar with Sistemi & Automazione shows how to carry out successful KYC (Know Your Customer) link analysis.

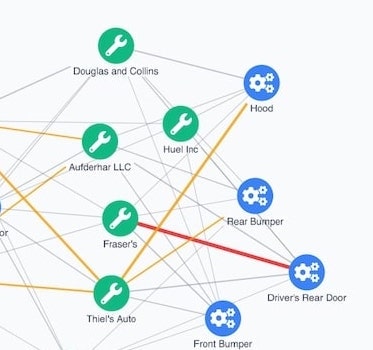

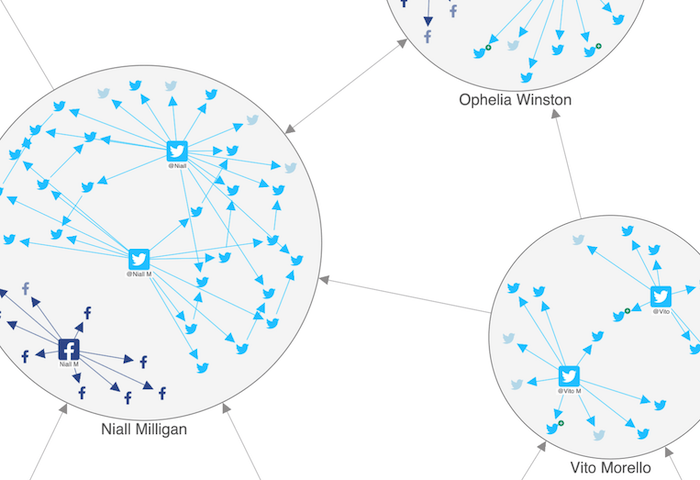

Sistemi & Automazione use our graph visualization technology to power their web-based link analysis application, Polaris.

We take a deep-dive into how Polaris simplifies data access and exploration through KYC link analysis. Using only open source information, it visualizes the due diligence steps needed to sign a fictional lucrative contract with one of the world’s most famous footballers.

Why use link analysis for KYC?

Most countries use regulatory compliance to make sure financial institutions and service providers take anti-money laundering (AML) seriously. Those institutions must carry out an extensive customer due diligence (CDD) and KYC process, but this involves more than just precise reporting and record keeping. They need to verify a customer’s identity, screen them against sanctions lists or watch lists, monitor transactions, check their connections to politically exposed persons (PEPs) and more.

This requires the collection and management of data from multiple sources at scale. How do organizations manage and make sense of it all? How do they identify financial irregularities and suspicious activities?

It’s hard to spot patterns and connections in a spreadsheet or table of information. The need for a fast and effective way to comply with CDD and KYC regulations drives many institutions and agencies to the latest analysis-based technology. And that means visualizing data to carry out KYC link analysis.

About Sistemi & Automazione

As the leading Italian company in the development of information analysis solutions and intelligence since 1995, Sistemi & Automazione are well-placed to advise best practise for KYC and link analysis. Their Polaris web app makes it easier to understand the events and connections around due diligence, AML, anti-fraud, risk assessment and reputational analysis.