Cryptocurrency has a reputation problem.

According to blockchain firm, Ciphertrace, 2019 saw a 533% increase in losses from cryptocurrency fraud, scams, and theft, totaling around $4.5bn. The technology has become the go-to currency for a new breed of criminals who take advantage of its pseudonymous nature and relative lack of government oversight in the form of AML (anti-money laundering) regulations.

But things are changing. Governments worldwide are grappling with ways to regulate the crypto world. In this 2-part series, we’ll see how tools for connected data visualization – or link analysis as it’s more commonly known by fraud analysts – help cryptocurrency exchanges and financial institutions to identify high-risk accounts and more easily comply with AML regulations in the age of the blockchain. Our examples looks specifically at XRP/Ripple, but it could easily apply to any cryptocurrency AML activities.

Cryptocurrency AML compliance and traditional banking

It’s thought a typical large US bank processes billions of dollars annually in undetected cryptocurrency-related transfers. A portion of this is likely to be illegally-obtained, or straightforward money laundering.

To get under the radar, criminals create shell companies using fake or stolen IDs. These entities become unlicensed money services businesses (MSBs), taking advantage of the relatively low level of scrutiny applied to business bank accounts to transfer large amounts of illicit funds.

Without a way to assess the risks posed by virtual asset service providers (VASPs), banks are increasingly refusing to work with cryptocurrency-related businesses. They lose out on potentially lucrative legitimate customers and force less scrupulous firms to hide the true nature of their business.

Why are cryptocurrency transactions so popular?

Short answer is it’s faster and cheaper to transfer funds compared with traditional banking systems, particularly to accounts overseas.

Here’s a basic example. Jo, in the US, wants to transfer $100 USD to Lesley, in Italy. Using a fiat system:

- Jo tells a US bank to transfer the funds.

- Jo’s bank issues instructions via the SWIFT network, taking a small fee.

- The Italian bank credit’s Lesley’s account with the funds, also taking a small fee.

Time taken: 3-5 days

Cost: up to $50 USD, + $3.20 SWIFT fee

Now compare this with a cryptocurrency approach. In this example we’ll use Ripple, the company and technology behind the XRP cryptocurrency (more on Ripple and XRP later).

- Jo instantly converts $100 USD into XRP tokens.

- Jo instructs the Ripple network to transfer those tokens to Lesley’s account using the XRP ledger infrastructure. The ledger is XRP’s decentralized system for managing secure XRP transactions.

- Lesley converts the new XRP tokens into Euros.

Time taken: a few seconds

Cost: $0.0001

As the popularity of legitimate cryptocurrency transactions increases, risk-averse financial organizations get left behind. People like Jo and Lesley want to carry out financial transactions using trustworthy money service businesses. Fiat-based financial services must follow strict AML regulations, but what about cryptocurrency AML compliance?

Cryptocurrency AML compliance: the updated FinCEN travel rule

Under US law’s Bank Secrecy Act, more commonly known as the ‘travel’ rule, financial institutions must keep comprehensive records of every transaction and be able to produce them in a timely manner. This legislation has been central to the government’s AML regulations for many years.

To guard against money laundering by virtual asset service providers, the US Treasury’s Financial Crimes Enforcement Network (FinCEN) expanded and clarified its travel rule. In short, this means VASPs must be categorized as MSBs or financial institutions, and have to follow the same AML obligations as banks, including:

- verifying customer identities

- identifying originators and beneficiaries of transfers of $3000 or higher

- transmitting that information to counterparties, if they exist

- keeping records for five years

U.S. Treasury led-Financial Action Task Force (FATF) told crypto exchanges and regulators worldwide that they’d need to comply from June 2020.

How XRP and Ripple is combating money laundering

At the time of writing, XRP is the world’s 4th largest cryptocurrency coin by market capitalization, with around $4.5bn USD equivalent in circulation.

The currency’s creator is the technology company, Ripple. It provides cryptographic ledger technology and is the single largest XRP token owner. Ripple has been especially proactive when it comes to its cryptocurrency AML compliance. In partnership with Coinfirm and Elliptic, they’ve investigated activity on their network, revealing about $400m of XRP tokens had been tied to illegal transactions.

Like most blockchain-based currencies, XRP transaction data is publicly available. This allows those of us interested in cryptocurrency AML compliance and fraud detection to explore and visualize the connections to find insight.

How does link analysis help with cryptocurrency AML compliance?

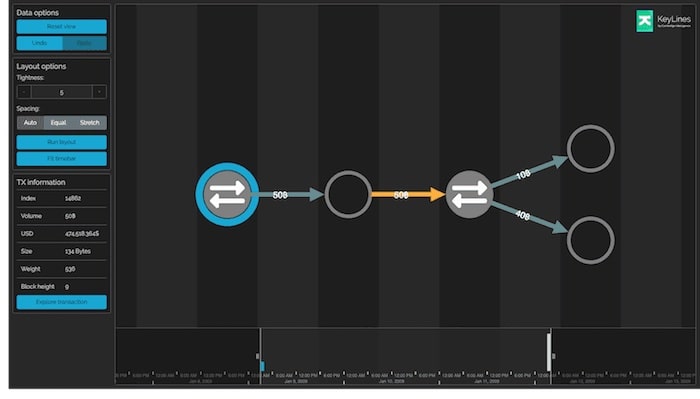

Visualization tools like KeyLines, our JavaScript graph visualization SDK and ReGraph, for React developers are vital for VASPs looking to actively manage their cryptocurrency AML compliance. Querying, collating and exploring financial transactions as a network of linked connections makes the process faster, simpler and more effective.

Financial records are typically vast and complex, so finding and tracking possible irregularities requires a robust data analysis process. Mapping them out manually would be an arduous manual process, but with link analysis or graph visualization tools, it’s easy to drill down into key individual transactions. Here are some Bitcoin transaction visualizations built with KeyLines .

Advanced filtering options give analysts the power to instantly pinpoint the exact transaction amount and the time it took place.

Improve your cryptocurrency AML compliance practices

In part two of this blog post, we show you each stage of the process for visualizing and analyzing XRP cryptocurrency, from building a graph model and designing a visual model, to exploring the data and revealing patterns of possible AML violations. You’ll see how our SDKs power tools that are essential to the compliance process.

In the meantime, if you want to learn more about how our products help manage risk and threat in financial services, download our financial services white paper