If I were to write about every challenge facing senior managers in the tech industry right now, this article would be an epic. Instead, I’ve explored survey results from some of the most reputable professional services and consulting firms to identify the eight main business concerns for CEOs in 2023, and suggest the best ways to tackle them.

With insights from PricewaterhouseCoopers (PwC), Gartner, Ernst & Young Global Limited (EY), Deloitte, the Gerson Lehrman Group (GLG) and the World Economic Forum, I’ll aim to make sense of the most difficult challenges facing senior executives. You’ll find links to each survey below

And because we’re the leading supplier of data visualization toolkits that make the world safer, I’ll also share what we’re doing to help the most successful global organizations we work with.

1. Facing disruptors and competitors

Inflation remains the top external disruptor for 74% of CEOs.

Across all of the surveys I looked at, the biggest external disruptors reported by CEOs were inflation and recession. And since the World Economic Forum’s Community of Chief Economists predict a global recession in 2023, businesses are bracing themselves for impact.

A global economic downturn should make staying ahead of your competition an even higher priority than usual. 59% of respondents to the GLG survey were either “moderately or highly concerned” about global competition, as organizations try to work out what it’ll take to become the market leader in a growing competitive landscape.

Interestingly, EY’s study found that 37% are “investing in data and technology to help them emerge from a potential recession in a stronger position than their competitors”.

Technology companies invest in our tools to enhance their current data analysis products and stay ahead of the competition. It’s why our data visualization toolkits power applications for the world’s most successful anti-fraud, cybersecurity and intelligence organizations.

But it’s not just existing competitors that organizations need to worry about. The PwC survey found that a third of participants “feared new players from related industries will most likely impact their industry’s profits in the next decade”. This seems borne out by the study’s findings that 35% of CEOs “plan to diversify their product offering”, while 48% “have done so or are doing so already”.

We’re finding greater diversity in the types of industry turning to our technology to extend their reach and give them a competitive advantage – everything from supply chain management to understanding blockchain

There’s also clear scope for existing businesses to move into new areas. For example, organizations working with knowledge graphs to understand retail, e-commerce and customer 360 already have the fundamental technology to explore similar connections in retail banking or research-intensive industries like healthcare and pharmaceuticals

2. Failing to deliver ROI

40% of global CEOs think their organization will no longer be economically viable in ten years’ time, if it continues on its current course.

We’ve talked already about the likelihood of a global recession in 2023 and the need to emerge stronger than your competitors. According to EY, “previous recessions have shown that CEOs who invested in future capabilities during the downturn benefited the most during the upturn”.

The question is: how much time and money should you invest now to grow your business? There’s obvious risk, but failure to invest could be the biggest risk of all.

Many organizations invest heavily in gathering, managing and storing their data. But much of the value in that data remains hidden because businesses don’t know how to uncover its potential. Visualization transforms the data into something that anyone can explore and understand. Tools like ours bring data to life, and investing in them is the obvious solution.

For more information, see How data visualization solves your big data ROI problem

3. Cyber threats and data breaches

A critical contributor to cybersecurity improvements at leading companies was C-suite collaboration to make the most of sustained, cumulative investments in risk mitigation.

According to PwC, 48% of CEOs are “increasing investments in cybersecurity or data privacy over the next 12 months to mitigate against geopolitical risks”, and 25% thought they’d be “highly or extremely exposed to cyber risks over the next 5 years”. GLG’s CEO panel responses showed that 90% “had made either some or significant plans for cybersecurity” in 2023.

There’s a contributing factor to this need for increased investment. As many organizations migrate more of their data assets to the cloud, the need for a robust cybersecurity strategy is more important than ever.

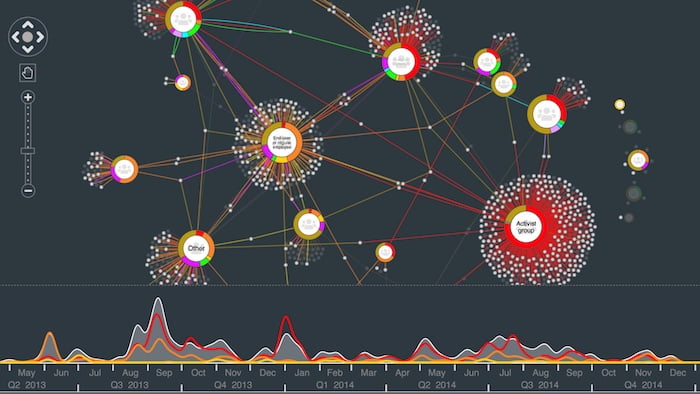

Our graph and timeline visualization technology is at the heart of some of the world’s most high profile cybersecurity applications, helping to predict, monitor and investigate attacks. Global organizations – including multinational banking and financial institutions – use our tools to power their mission-critical internal cybersecurity applications.

We help cyber analysts to understand cyber threat intelligence: identify which threats exist and how they could impact an organization, flag alerts when a potential attack is detected, and find the root cause of complex data breaches to patch vulnerabilities.

4. Losing touch with the latest technologies

Technology investments are a top priority: around 75% of companies are focused on automation, upskilling, and deploying advanced technologies.

The PwC survey found that 40% of UK CEOs believed their company’s current technological capabilities “were not good enough to meet their strategic objectives, and thought the problem would get worse without urgent action”. It’s unsurprising, then, that the survey also found that 62% of CEOs are “reinventing their business for the future by deploying technology”, including Cloud services, AI and other advancements.

Our market-leading graph visualization SDK technology marks the difference between a good data analysis web application and a future-proof one. Successful investigative apps include a visualization element so users can explore their data connections interactively, use the latest graph algorithms to uncover hidden patterns, and feature unlimited customization options for an intuitive user experience.

We’re also at the forefront of visual timeline analytics: a compelling new way to explore events through time, which has already established itself as an essential technique for successful data analysis. Our KronoGraph timeline analytics toolkit powers web apps in use cases as varied as AI and fraud detection.

Considering other data visualization options

Of course, there are alternative ways to invest in visualizing your data. Free or low-cost code libraries, off-the-shelf visualization tools, diagramming applications or even home-grown options may deliver some of the advantages that make data more accessible to users. We cover some of these alternatives in A product manager’s guide to data visualization options

Problems arise when you reach the limits of these alternatives and your project is already running late. You discover that your users are missing key interactive elements to support their workflows, and there are no technical experts for the development team to turn to.

We’ve had firsthand experience of each of these scenarios from customers who invested in a cheaper data visualization option initially, but came back to us six months later wishing they’d worked with us from the start.

Our browser-based data visualization technology is trusted by everyone from national governments to multinational corporations, Fortune 500 companies to innovative startups. Meet our customers

5. Becoming irrelevant

Customer experience emerged as the number one priority.

Business leaders know that in order to stay relevant, they need to keep giving their customers what they want. Happy customers who feel that vendors understand their pain points, care about their success, and give them the support they need at every stage are more likely to stay loyal.

GLG’s global panel of CEOs ranked customer service as “their top priority for 2023, with 60% of respondents ranking it so”. We can correlate this with EY’s survey that found 32% of CEOs surveyed “aim to boost customer loyalty over the next 6 months using technology to optimize product suites and services”.

We’re continuously listening to customers, improving our toolkits and developing groundbreaking new features they can use to guarantee a great user experience. Those end users need to find actionable insights in their data and uncover threats fast, so that they can make business-critical decisions when it matters most. Help them do their jobs more efficiently and they’ll reward you with their loyalty.

As a bonus, they might even tell others about what a fantastic experience they’ve had

6. Falling behind on sustainability & ethical credentials

Business leaders are now under pressure from customers, investors, regulators and employees to do more on environmental sustainability.

Another obvious way to stay relevant is to keep up with industry trends, and sustainability is a priority for many organizations right now. Of those surveyed by EY, 33% felt the most important strategic action to follow in the next 6 months was “to build sustainability and ESG (Environmental, Social and Governance) as a core aspect of all products and services to engage customers”.

We know from experience that assessing the sustainability credentials of suppliers is a difficult task. We’re completely transparent about our plans, having signed up to TechNation’s Tech Zero’s commitment to becoming a net zero business by the end of 2030. Annual reports on our Tech Zero progress are available to download, and our annual carbon emissions, audited by a third party environmental consulting group, are published on this site. For the greater good, we’re keen to share best practices and metrics with customers, non-customers and competitors alike.

As for governance and ethics, CEOs risk reputational damage if they do business with organizations that make headlines for the wrong reasons. We have a strict ethical licensing policy to protect against this, as customers’ activities must align with our commitment to working in a fair and ethical way.

We also believe that better data visualization makes the world a safer place. Our customers do incredible things with our technology, from preventing cyber attacks and detecting fraud, to stopping terrorism and the exploitation of vulnerable groups.

7. Losing talented staff & struggling to replace them

Nearly all CEOs (96%) plan to focus on the employee experience for in-demand talent.

From the largest global technology firms to new startups, there’ve been significant layoffs in the tech industry so far this year. Although sanctioning redundancies is a potential reality for many organizations, all of the surveys I explored identified issues around talent acquisition and retention. In Gartner’s survey, 31% of CEOs prioritized workforce problems, making it the third most important area behind growth and tech-related issues.

How do you attract the best people and grow your team in a difficult economic climate? And how do you keep your existing team happy and engaged?

EY recognizes the “fine line between managing costs and preserving investment in talent”. Without the best people to do the job, there’s limited opportunity for growth. Finding and retaining those people is a multifaceted process: offering flexible working options, promoting wellbeing initiatives, committing to effective Equality, Diversity and Inclusion (EDI) processes, and more.

A primary attraction for employees is the promise of fulfilling work. In the tech sector in particular, developers want to work with cutting-edge technologies and their favorite coding languages. They’re eager to build something innovative and exceptional. They’re happy when they see investments in the latest tools and libraries to support product development. Get the best people, give them the best tools, get the best results.

Developers love working with our toolkits. We give them fully-documented APIs, detailed developer guides and expert first-line support from the teams that built the tools. Devs can access dynamic demonstrations of every feature, with downloadable examples to save coding from scratch.

The best recommendation for us is when a developer at one of our customers switches employers and petitions their new boss to start using our toolkits, because they’re so much better than their current visualization solution.

8. Falling at the first hurdle

As a team of experienced and skilled professionals, you and your senior managers most likely have solutions to many of the CEO fears highlighted here. You may have a robust plan for growth despite the economic downturn, a strategy to keep delighting end users, a plan to invest in the right technologies, a renewed cybersecurity initiative, plus a healthy pipeline of ideas for talent acquisition and retention.

But the greatest stumbling block could be turning all of those into actions. How do you get these bright ideas off the ground?

When organizations turn to us for help, we get them off to a strong start and make sure they keep momentum.

When you sign up for a free trial of our data visualization toolkits, you’ll get a session with an expert who’ll work to understand your project and identify how we can help make it a reality. Our Customer Success team checks in regularly with useful information and assistance, and if you need extra help to realize your ambitions or design the best application for your users, our Commercial Development team can demonstrate how to turn your connected data into the eye-catching visualizations you have in mind.

There’s nothing to fear here

There may be economic turbulence ahead, but with the right people, strategies and technologies in place, forward-thinking CEOs have nothing to fear.

If you want to know more about the tools that can bring your connected data to life, request a free trial or get in touch and we’ll arrange a call with one of our experienced sales managers.

Sources

PwC’s 26th Annual Global CEO Survey 2023 – 4,410 chief executives from 105 countries and territories

Fall 2022 Fortune/Deloitte Survey – 121 CEOs

Nov 2023 Gerson Lehrman Group, Inc. (GLG) CEO Survey – 458 CEOs across a range of industries with 150 respondents from N America, 158 from EMEA and 150 from APAC

EY CEO Outlook Pulse Survey Jan 2023 – 1200 CEOs globally

Gartner Survey 2022-23 – 400 senior business leaders across various industries