Our graph and timeline visualization toolkits help make sense of complex connected data. When we’re asked which use cases benefit from our technology, the answer is simple: almost all of them. The challenge to understand hidden relationships and uncover actionable insights from data is universal, across countless data visualization use cases.

In this blog post, we focus on seven of the most popular:

Why visualize data as a graph?

It’s intuitive – presenting a graph as a node-link structure instantly makes sense, even to people who’ve never worked with graphs before. It’s fast – our brains are great at spotting patterns, but only when data is presented in a tangible format. Data visualization makes it easy for us to identify trends and outliers. It’s flexible – the world is densely connected, so as long as there’s an interesting relationship in your data somewhere, you’ll find value in a graph visualization. It’s insightful – an interactive graph visualization allows users to gain deeper knowledge, understand context and ask more questions. It’s far easier to explore than raw data, or a static visualization.

Graph visualization has become a must-have data analysis tool in a growing number of domains. Let’s take a look at the most popular data visualization use cases.

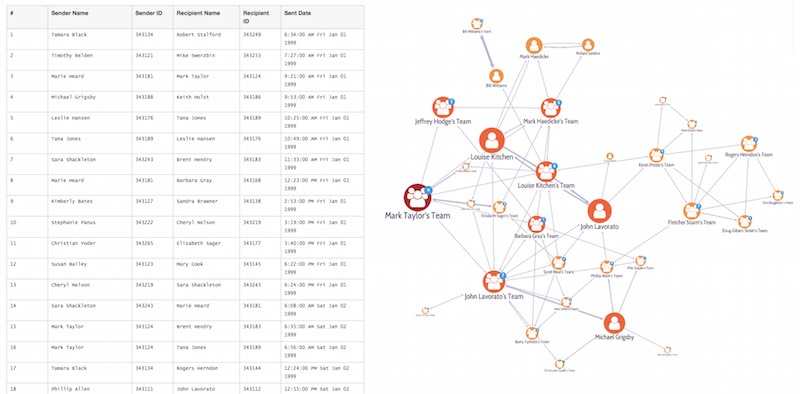

Law enforcement and security

Criminal investigators have used graph visualization for decades. What has changed in forensic data visualization use cases over time is the technology used to make the process more automated and scalable.

After the 9/11 terror attacks, the intelligence services reflected on their failure to analyze the bigger, joined-up picture. They quickly developed an interest in link analysis software for law enforcement and security agencies. They designed new approaches and technologies for large-scale data analysis of communications records, open-source intelligence (OSINT), and police databases.

Lawful interception, the legally mandated interception of personal communications data, provides huge volumes of data on criminal and terrorist activity. Non-specialist staff were able to pair social network analysis with graph visualization techniques to explore the data and uncover important insight. They use these techniques on everything from visualizing OSINT data to support due diligence investigations to uncovering human trafficking activity.

Because this kind of analysis is so complex and specialized, many law enforcement agencies use our toolkits to build their own visualization solutions, instead of relying on off-the-shelf products. The scale of the data they work with has also transformed the nature of the visualization: it’s now essential to have effective layouts, filtering and grouping, as well as powerful graphics rendering.

If you want more examples, this webinar with Neo4j shows how visualizing data from crime records helps users to understand patterns and allocate resources wisely. And Big data & law enforcement visualizations explains two possible uses for visualization in an event and investigation-led approach.

Fraud detection and management

The financial services industry was another early adopter of graph visualization techniques. Fraud detection is about finding unusual connections between things like accounts, transactions, insurance policies, and devices. There’s great value in visualizing that data as a graph.

Graph analysis techniques are widely used in the banking and insurance industries. And over time, we’ve seen them used to tackle other kinds of fraud, including healthcare fraud, gambling fraud, review fraud and even fake news.

Take blockchain transactions, for example. This graph visualization tracks six minutes of fast-paced, complicated Bitcoin transactions in an intuitive, explorable way:

As we discussed in data visualization, AI and fraud detection, we’re seeing an increase in the use of AI in fraud detection, alongside the emergence of new AI-driven fraud techniques. This has introduced a heightened level of complexity to managing fraud.

Historically, financial services providers have relied on known fraud indicators to detect bad actors. But many of them are now using machine learning models to identify the latest trends in money laundering, developing advanced algorithms that continuously evolve and improve.

Bringing a graph visualization to their AI-driven fraud management tool gives them a fast understanding of complex patterns of behavior, prioritizing alerts and taking action when it matters most.

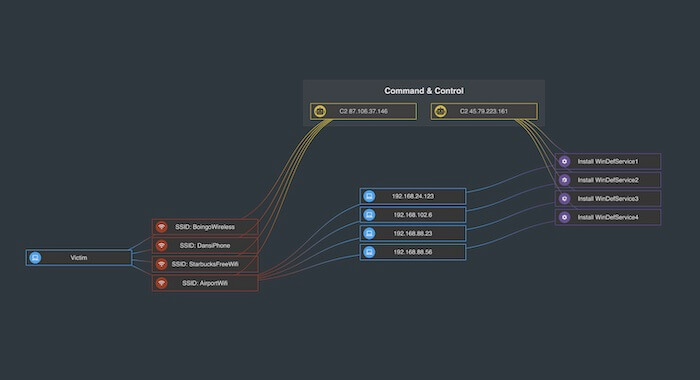

Cyber Security

Cyber security is about understanding network vulnerabilities and protecting them from malicious attacks. Data is measured in terabytes, and it’s not unusual for enterprises to handle billions of alerts each day.

Analysts can’t hope to review every alert, but without the visualization tools to understand the big picture, they can’t perform effective triage either. The result: alerts get missed, vulnerabilities are exploited and post-attack forensics are inefficiently managed.

It’s no surprise that cyber security is the fastest-growing graph data visualization use case. It’s becoming the go-to tool for cyber analysts. Enhancing their existing SIEM dashboards with a powerful graph component gives them access to the joined-up intelligence they need, in the right place at the right time.

Even if an analyst can’t stop a current attack, graph visualization can still help them understand and prevent it from happening again. Tracking the propagation of malware through a network reveals susceptible and potentially compromised machines. This graph demonstrates how a malware attack on one machine infected four others:

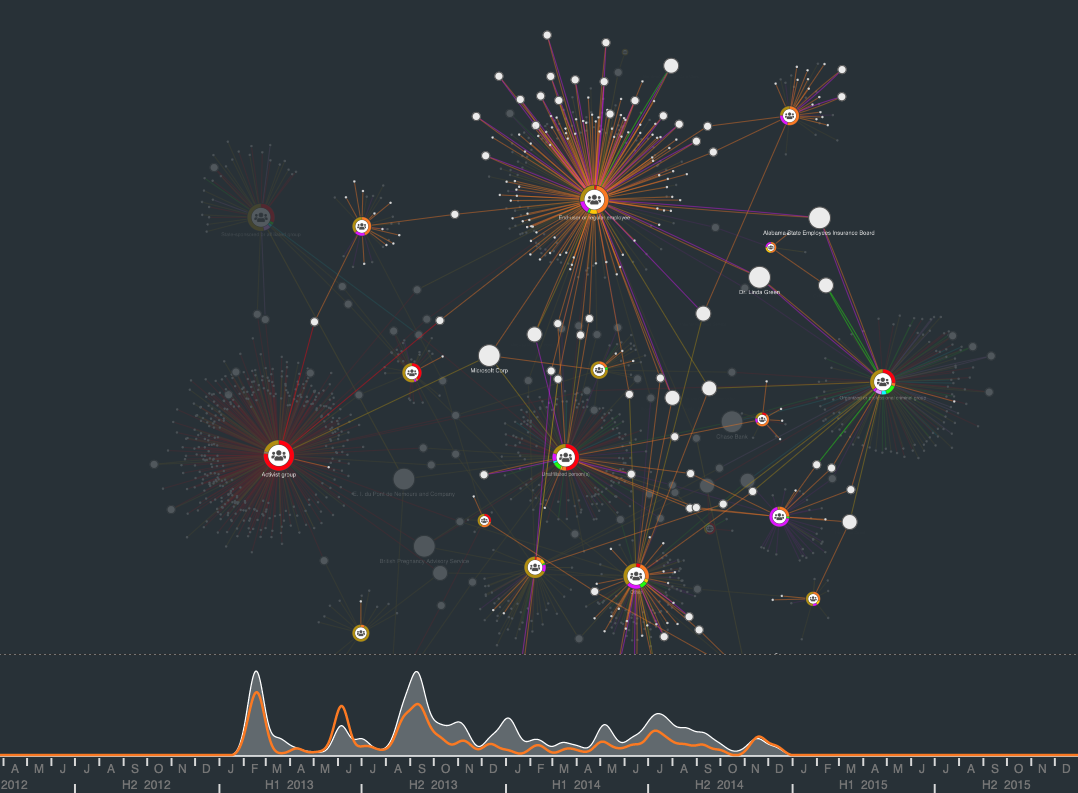

In another example, we explore the VERIS database of data breaches, looking for patterns in how the breaches happen and finding out who’s responsible. This chart uses the time bar to offer a dynamic view of what happened when:

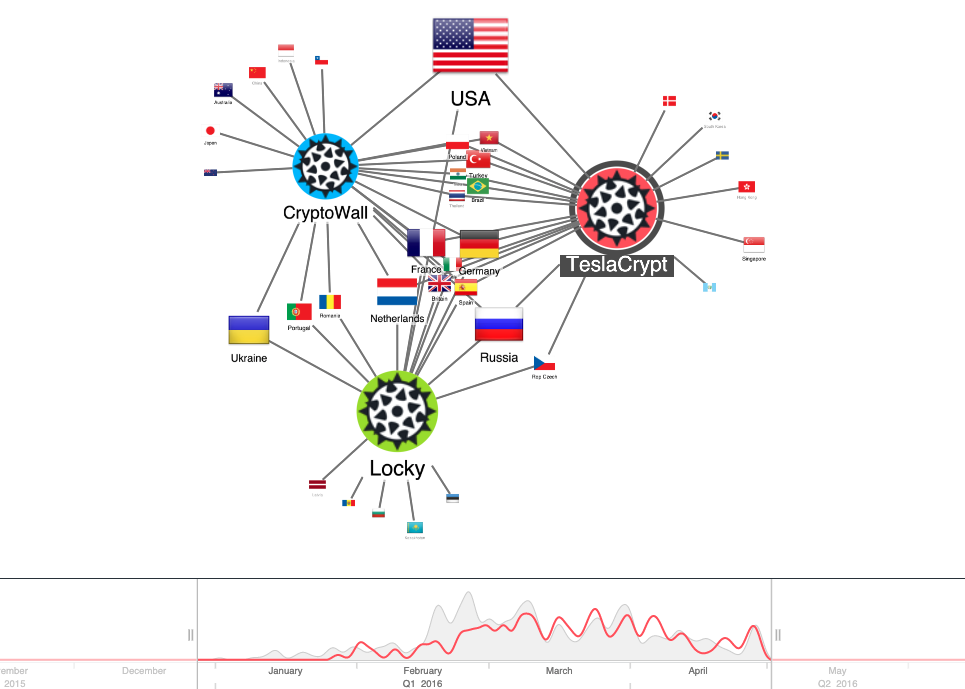

Complex malware data can be visualized as a graph. The combos and time bar features in our toolkits can help analysts pinpoint trends and entry points in network structures.

Sharing intelligence

Graph visualization isn’t just for analysis of past events, and mapping scenarios: it’s also key to intelligence dissemination. Our toolkits help you to communicate complex data quickly and simply. You can share insightful, intuitive graph visualizations with colleagues and decision-makers in the format that works for you – whether it’s a link to an interactive chart, a high-res print-out or an emailed JPEG. Find out more in Intelligence dissemination made easy with PDF exports

Regulatory compliance

Organizations need to manage and prove compliance with relevant laws, regulations and standards. This often involves grappling with complex scenarios and data to understand non-compliance risk. Graph visualization is the perfect tool for the process.

AML and KYC

In financial services, due diligence processes like Know Your Customer (KYC) and Anti-Money Laundering (AML) are especially cumbersome. An understanding of customer history and behaviors depends on a strong data analysis process and an interactive graph visualization tool.

Banking organizations use our graph and timeline visualization SDKs to uncover risks like:

Politically Exposed Persons (PEPs) – high-profile individuals who need enhanced due diligence

Beneficial owners – exploring networks of entities to understand a customer’s control and ownership structure

Correspondent banking relationships – preventing the misuse of international banking relationships

Data protection and GDPR

Data protection regulations are ideal candidates for a graph-led approach.

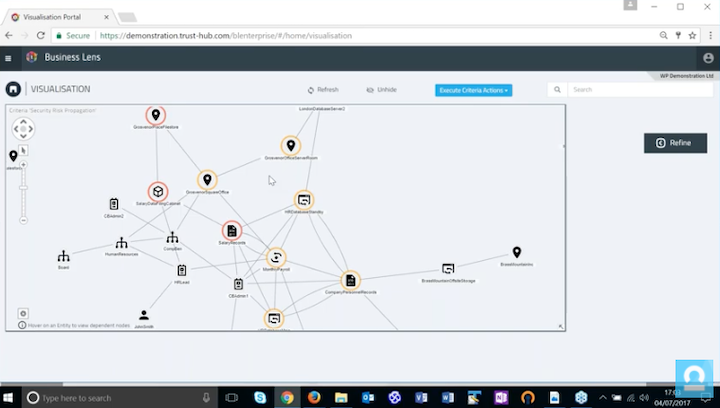

Data protection regulations are ideal candidates for a graph-led approach. In this webinar with graph and GDPR experts trust-hub, we demonstrate the role of visualization in data privacy lifecycle management:

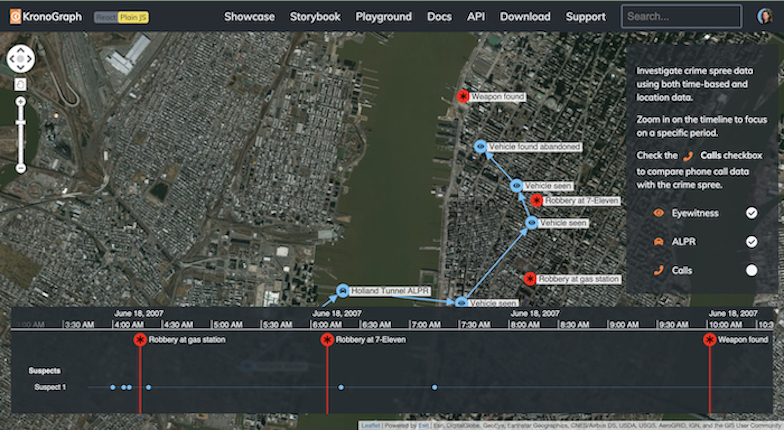

Logistics and operations

Graph visualization is the ideal tool to understand flow. Organizations need efficient, traceable supply chains that can adapt to change and avoid bottlenecks.

IoT, telecoms, oil and gas – these industries rely on physical networks of infrastructure to function. A relatively minor failure in those networks can cause critical problems costing millions of dollars.

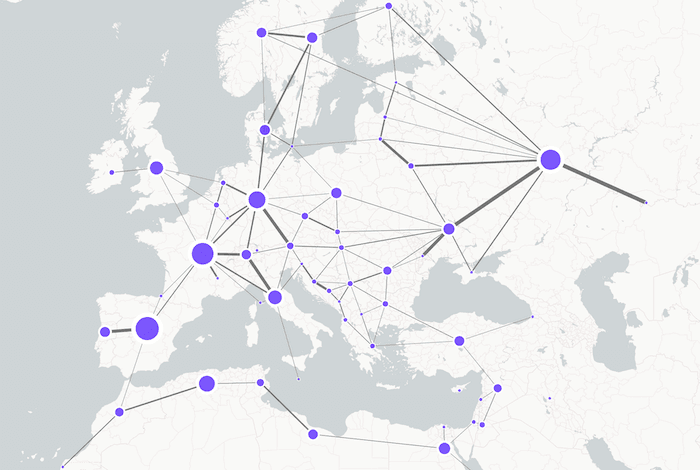

To counter that risk, companies have invested heavily in network analysis tools, collating terabytes of data that show flow and dependencies. Graph analysis techniques like social network analysis and filtering bring out the most important parts of the network, which users can examine further with graph visualization.

A supply chain isn’t really a chain – it’s a network that needs careful management. This graph and timeline visualization shows how KronoGraph, our time-based visual analytics toolkit, supports a reliable management tool with supply chain network visualization at its heart:

In this webinar, hosted with multi-model database firm ArangoDB, we walk through the example of IT infrastructure, uncovering key dependencies in the network to run precise and straightforward impact analysis.

Knowledge management

The final use case we’re going to cover is perhaps the broadest: knowledge graphs.

Take Google, for example. While their early competitors tried to flatten the internet’s densely connected network of information into a huge library catalogue, Google understood the power of the graph and embraced the connected nature of data. They explore the connections between sites, promote those with more authority and generate a more helpful view of the internet.

Now, with the democratization of graph technologies, individual firms can follow suit. Enterprises worldwide are investing in silo-breaking projects to centralize and connect their organization knowledge.

Also think about the vastly complex neural networks that rely on natural language processing (NLP) to interpret queries and communicate results to users. AI models like ChatGPT and Bard are essentially huge knowledge graphs created in real time.

The best business strategies depend on a deep understanding of complex information. Graph visualization helps successful businesses cut through noise, uncover connections and extract actionable insights with minimal effort. Traversals: powering the intelligence cycle for business shows how a SaaS intelligence platform uses our graph technology to drive business-critical decisions.

Detangling patents with KeyLines shows how understanding IP is a vital part to many business strategies. Graph visualization clarifies the landscape, revealing risks and opportunities.

Another customer developed a graph-powered insights engine that uses natural language processing to help users uncover insight in their connected data. The insights engine generates knowledge graphs that are visualized using KeyLines, our graph visualization toolkit for JavaScript developers. Read more in How Hume & KeyLines make levels of insight skyrocket

How can graph visualization help you?

In any scenario where you need to understand the nature of a relationship quickly and confidently, graph visualization is an essential addition to your project roadmap. If you’d like to try it out for yourself, you can start a trial, or just get in touch.